Tax Increment Financing

The City of Dillon; Dillon Main Street, LLC; Beaverhead Chamber of Commerce, Tourism & Development; and Headwaters RC&D have received funding through The Montana Department of Commerce’s Office of Research and Economic Analysis (ORE) Grant to fund strategic planning activities related to the potential establishment of a Targeted Economic Development District (TEDD) and Urban Renewal District (URD) in Dillon. We are working with Pioneer Technical Services on this project.

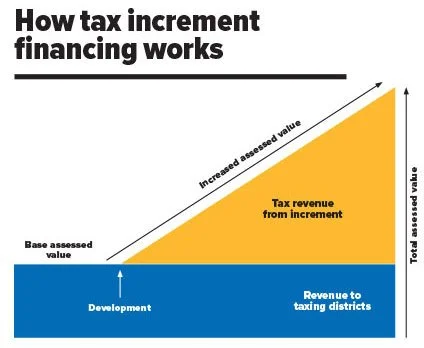

What is Tax Increment Financing?

Tax Increment Financing (TIF) is a way for certain districts to use property tax revenue to fund new development. It works by separating taxable value into base and increment values, so that revenue from the base value continues to go to the regular taxing jurisdiction, but as taxes increase over the years, that growth—the increment—go to the TIF to pay for development activities within the TIF district.

The development of TIF districts is authorized by 7-15-4282, MCA.

Visit Montana Department of Revenue’s website to learn more about how TIFs work

Types of Tax Increment Financing Districts

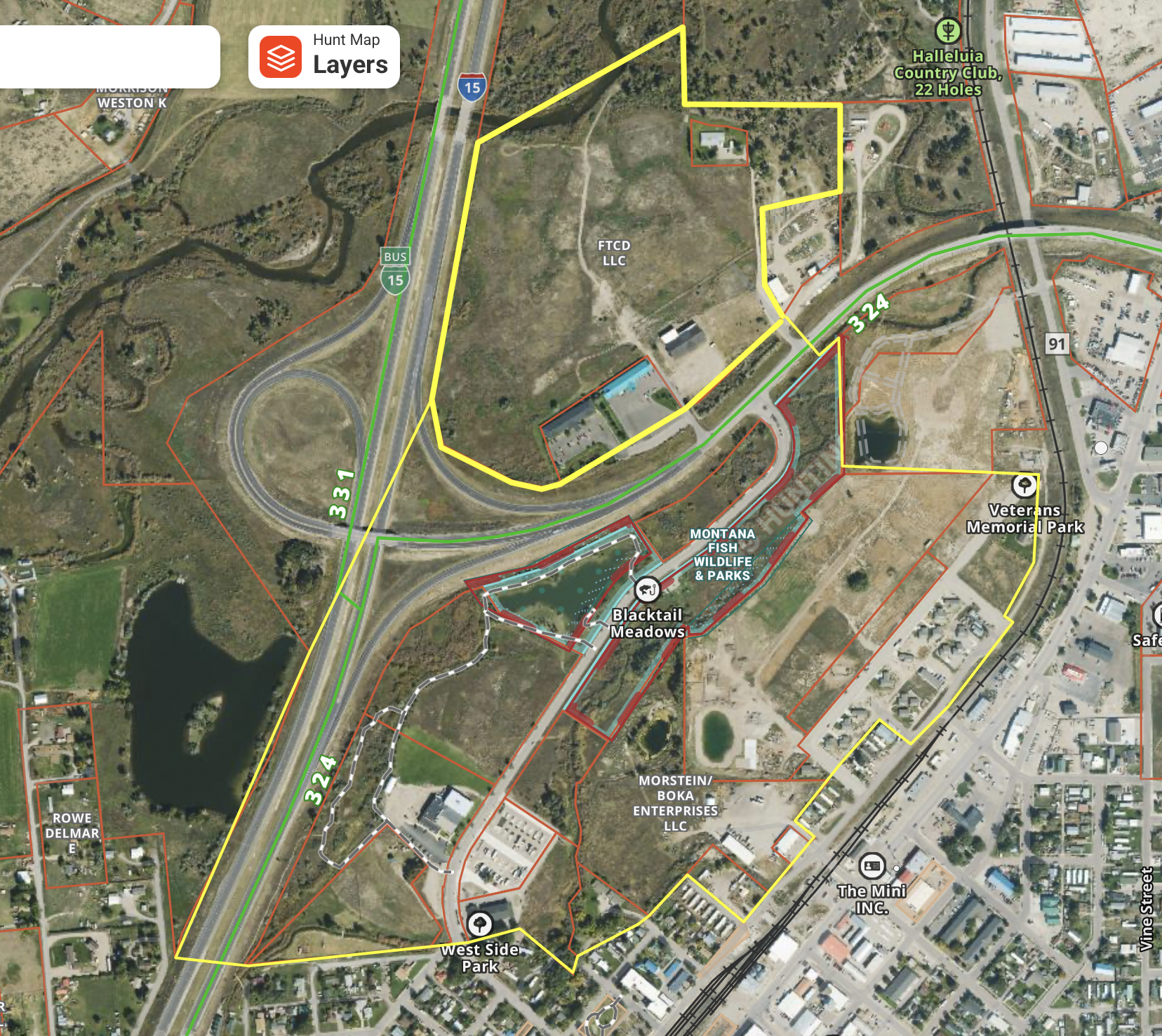

In Montana, Tax Increment Financing (TIF) districts are primarily divided into two active types created for redevelopment: Urban Renewal Districts (URDs) to fix blight, and Targeted Economic Development Districts (TEDDs) to address infrastructure deficiencies.

Example TEDD (Targeted Economic Development District) Boundary

Example URD (Urban Renewal District) Boundary